Models of systemic risk

The term 'systemic risk' denotes the risk that a whole system consisting of many interacting agents fails. We see systemic risk as a macroscopic property that emerges from the nonlinear interactions of agents. This differs from a conventional view that focuses on the probability of single extreme events, e.g. earthquakes or big meteors hitting the earth, that seriously damage the system. It also differs from a perspective, for example, used in finance, where a single agent is big enough to damage the whole system - which leads to the notion of systemic importance. In addition to all these ingredients, our systemic perspective emphasizes the impact of individual failure exerted on other agents. I.e., the systemic failure can start with the failure of a few agents which is amplified both by interaction mechanisms and by systemic feedback. This can lead to failure cascades which span a significant part of the system.

We provide a general framework for modelling systemic risk which was first applied to fully connected networks and is being extended to networks with arbitrary degree distribution from a formal theoretical point of view. Since we also allow for nodes to have heterogeneous robustness, various applications and extensions of the existing models are possible. They include credit networks, supply networks or social online networks where cascades of leaving users may threaten the existence of the platform.

Our approach is based on the concept of complex networks, where agents are represented by nodes in a network, whereas their interactions are modelled by links between them. Both nodes and links can follow their own dynamics and influence each other by feedback effects. In order to understand the emergence of systemic risk, we have to model (a) the internal dynamics of the agents, which is largely neglected in other approaches, (b) the interaction dynamics of the agents (in particular the network topology), (c) macroscopic or systemic feedback, i.e. the impact of changing external conditions, (d) trend reinforcement, i.e. the fact that interactions are path dependent and depend on the history of previous interactions.

Systemic risk in multiplex networks with asymmetric coupling and threshold feedback

|

[2016]

|

|

Burkholz, Rebekka;

Leduc, Matt;

Garas, Antonios;

Schweitzer, Frank

|

Physica D,

pages: 64--72,

volume: 323-324

|

more» «less

|

Abstract

We study cascades on a two-layer multiplex network, with asymmetric feedback that depends on the coupling strength between the layers. Based on an analytical branching process approximation, we calculate the systemic risk measured by the final fraction of failed nodes on a reference layer. The results are compared with the case of a single layer network that is an aggregated representation of the two layers. We find that systemic risk in the two-layer network is smaller than in the aggregated one only if the coupling strength between the two layers is small. Above a critical coupling strength, systemic risk is increased because of the mutual amplification of cascades in the two layers. We even observe sharp phase transitions in the cascade size that are less pronounced on the aggregated layer. Our insights can be applied to a scenario where firms decide whether they want to split their business into a less risky core business and a more risky subsidiary business. In most cases, this may lead to a drastic increase of systemic risk, which is underestimated in an aggregated approach.

How damage diversification can reduce systemic risk

|

[2016]

|

|

Burkholz, Rebekka;

Garas, Antonios;

Schweitzer, Frank

|

Physical Review E,

pages: 042313,

volume: 93

|

more» «less

|

Abstract

We study the influence of risk diversification on cascading failures in weighted complex networks, where weighted directed links represent exposures between nodes. These weights result from different diversification strategies and their adjustment allows us to reduce systemic risk significantly by topological means. As an example, we contrast a classical exposure diversification (ED) approach with a damage diversification (DD) variant. The latter reduces the loss that the failure of high degree nodes generally inflict to their network neighbors and thus hampers the cascade amplification. To quantify the final cascade size and obtain our results, we develop a branching process approximation taking into account that inflicted losses cannot only depend on properties of the exposed, but also of the failing node. This analytic extension is a natural consequence of the paradigm shift from individual to system safety. To deepen our understanding of the cascade process, we complement this systemic perspective by a mesoscopic one: an analysis of the failure risk of nodes dependent on their degree. Additionally, we ask for the role of these failures in the cascade amplification.

Quantifying the Impact of Leveraging and Diversification on Systemic Risk

|

[2014]

|

|

Tasca, Paolo;

Mavrodiev, Pavlin;

Schweitzer, Frank

|

Journal of Financial Stability,

pages: 43-52,

volume: 15,

number: 0

|

more» «less

|

Abstract

The excessive increase of leverage, i.e. the abuse of debt financing, is considered one of the primary factors in the default of financial institutions since it amplifies potential investment losses. On the other side, portfolio diversification acts to mitigate these losses. Systemic risk results from correlations between individual default probabilities that cannot be considered independent. Based on the structural framework by Merton (1974), we propose a model in which these correlations arise from overlaps in banks’ portfolios. Our main result is the finding of a critical level of diversification that separates two regimes: (i) a safe regime in which a properly chosen diversification strategy offsets the higher systemic risk engendered by increased leverage and (ii) a risky regime in which an inadequate diversification strategy and/or adverse market conditions, such as market size, market volatility and time horizon, cannot compensate the same increase in leverage. Our results are of relevance for financial regulators especially because the critical level of diversification may not coincide with the one that is individually optimal.

How big is too big? Critical shocks for systemic failure cascades

|

[2013]

|

|

Tessone, Claudio Juan;

Garas, Antonios;

Guerra, Beniamino;

Schweitzer, Frank

|

Journal of Statistical Physics,

pages: 765-783,

volume: 151,

number: 3

|

more» «less

|

Abstract

External or internal shocks may lead to the collapse of a system consisting of many agents. If the shock hits only one agent initially and causes it to fail, this can induce a cascade of failures among neighoring agents. Several critical constellations determine whether this cascade remains finite or reaches the size of the system, i.e. leads to systemic risk. We investigate the critical parameters for such cascades in a simple model, where agents are characterized by an individual threshold $$theta_i determining their capacity to handle a load $$alpha$$theta_i with 1-$$alpha being their safety margin. If agents fail, they redistribute their load equally to K neighboring agents in a regular network. For three different threshold distributions P($$theta), we derive analytical results for the size of the cascade, X(t), which is regarded as a measure of systemic risk, and the time when it stops. We focus on two different regimes, (i) EEE, an external extreme event where the size of the shock is of the order of the total capacity of the network, and (ii) RIE, a random internal event where the size of the shock is of the order of the capacity of an agent. We find that even for large extreme events that exceed the capacity of the network finite cascades are still possible, if a power-law threshold distribution is assumed. On the other hand, even small random fluctuations may lead to full cascades if critical conditions are met. Most importantly, we demonstrate that the size of the "big" shock is not the problem, as the systemic risk only varies slightly for changes of 10 to 50 percent of the external shock. Systemic risk depends much more on ingredients such as the network topology, the safety margin and the threshold distribution, which gives hints on how to reduce systemic risk.

Bootstrapping Topological Properties and Systemic Risk of Complex Networks Using the Fitness Model

|

[2013]

|

|

Musmeci, Nicolo;

Battiston, Stefano;

Caldarelli, Guido;

Puliga, Michelangelo;

Gabrielli, Andrea

|

Journal of Statistical Physics,

pages: 720-734,

volume: 151,

number: 3-4

|

more» «less

|

Abstract

In this paper we present a novel method to reconstruct global topological properties of a complex network starting from limited information. We assume to know for all the nodes a non-topological quantity that we interpret as fitness. In contrast, we assume to know the degree, i.e. the number of connections, only for a subset of the nodes in the network. We then use a fitness model, calibrated on the subset of nodes for which degrees are known, in order to generate ensembles of networks. Here, we focus on topological properties that are relevant for processes of contagion and distress propagation in networks, i.e. network density and k-core structure, and we study how well these properties can be estimated as a function of the size of the subset of nodes utilized for the calibration. Finally, we also study how well the resilience to distress propagation in the network can be estimated using our method. We perform a first test on ensembles of synthetic networks generated with the Exponential Random Graph model, which allows to apply common tools from statistical mechanics. We then perform a second test on empirical networks taken from economic and financial contexts. In both cases, we find that a subset as small as 10 % of nodes can be enough to estimate the properties of the network along with its resilience with an error of 5 %.

Default Cascades in Complex Networks: Topology and Systemic Risk

|

[2013]

|

|

Roukny, Tarik;

Bersini, Hugues;

Pirotte, Hugues;

Caldarelli, Guido;

Battiston, Stefano

|

Scientific Reports,

pages: 2759,

volume: 3

|

more» «less

|

Abstract

The recent crisis has brought to the fore a crucial question that remains still open: what would be the optimal architecture of financial systems? We investigate the stability of several benchmark topologies in a simple default cascading dynamics in bank networks. We analyze the interplay of several crucial drivers, i.e., network topology, banks' capital ratios, market illiquidity, and random vs targeted shocks. We find that, in general, topology matters only – but substantially – when the market is illiquid. No single topology is always superior to others. In particular, scale-free networks can be both more robust and more fragile than homogeneous architectures. This finding has important policy implications. We also apply our methodology to a comprehensive dataset of an interbank market from 1999 to 2011.

Default Cascades: When Does Risk Diversification Increase Stability?

|

[2012]

|

|

Battiston, Stefano;

Delli Gatti, Domenico;

Gallegati, Mauro;

Greenwald, Bruce C. N.;

Stiglitz, Joseph E.

|

Journal of Financial Stability,

pages: 138-149,

volume: 8,

number: 3

|

more» «less

|

Abstract

Software development depends on many factors, including technical, human and social aspects. Due to the complexity of this dependence, a unifying framework must be defined and for this purpose we adopt the complex networks methodology. We use a data-driven approach based on a large collection of open source software projects extracted from online project development platforms. The preliminary results presented in this article reveal that the network perspective yields key insights into the sustainability of software development.

Liaisons Dangereuses: Increasing Connectivity, Risk Sharing, and Systemic Risk

|

[2012]

|

|

Battiston, Stefano;

Gatti, Domenico Delli;

Gallegati, Mauro;

Greenwald, Bruce C. N.;

Stiglitz, Joseph E.

|

Journal of Economic Dynamics and Control,

pages: 1121-1141,

volume: 36,

number: 8

|

more» «less

|

Abstract

The recent financial crisis poses the challenge to understand how systemic risk arises endogenously and what architecture can make the financial system more resilient to global crises. This paper shows that a financial network can be most resilient for intermediate levels of risk diversification, and not when this is maximal, as generally thought so far. This finding holds in the presence of the financial accelerator, i.e. when negative variations in the financial robustness of an agent tend to persist in time because they have adverse effects on the agent's subsequent performance through the reaction of the agent's counterparties.

Default cascades: When does risk diversification increase stability?

|

[2012]

|

|

Battiston, Stefano;

Gatti, Domenico Delli;

Gallegati, Mauro;

Greenwald, Bruce;

Stiglitz, Joseph E.

|

Journal of Financial Stability,

pages: 138-149,

volume: 8,

number: 3

|

more» «less

|

Abstract

We explore the dynamics of default cascades in a network of credit interlink-ages in which each agent is at the same time a borrower and a lender. When some counterparties of an agent default, the loss she experiences amounts to her total exposure to those counterparties. A possible conjecture in this context is that individual risk diversification across more numerous counterparties should make also systemic defaults less likely. We show that this view is not always true. In particular, the diversification of credit risk across many borrowers has ambiguous effects on systemic risk in the presence of mechanisms of loss amplifications such as in the presence of potential runs among the short-term lenders of the agents in the network.

Market Procyclicality and Systemic Risk

|

[2012]

|

|

Tasca, Paolo;

Battiston, Stefano

|

SSRN Electronic Journal

|

more» «less

|

Abstract

We model the systemic risk associated with the so-called balance-sheet amplification mechanism in a system of banks with interlocked balance sheets and with positions in real-economy-related assets. Our modeling framework integrates a stochastic price dynamics with an active balance-sheet management aimed to maintain the Value-at-Risk at a target level. We find that a strong compliance with capital requirements, usually alleged to be procyclical, does not increase systemic risk unless the asset market is illiquid. Conversely, when the asset market is illiquid, even a weak compliance with capital requirements increases significantly systemic risk. Our findings have implications in terms of possible macro-prudential policies to mitigate systemic risk.

DebtRank: Too Central to Fail? Financial Networks, the FED and Systemic Risk

|

[2012]

|

|

Battiston, Stefano;

Puliga, Michelangelo;

Kaushik, Rahul;

Tasca, Paolo;

Caldarelli, Guido

|

Scientific Reports,

pages: 541,

volume: 2

|

more» «less

|

Abstract

Systemic risk, here meant as the risk of default of a large portion of the financial system, depends on the network of financial exposures among institutions. However, there is no widely accepted methodology to determine the systemically important nodes in a network. To fill this gap, we introduce, DebtRank, a novel measure of systemic impact inspired by feedback-centrality. As an application, we analyse a new and unique dataset on the USD 1.2 trillion FED emergency loans program to global financial institutions during 2008-2010. We find that a group of 22 institutions, which received most of the funds, form a strongly connected graph where each of the nodes becomes systemically important at the peak of the crisis. Moreover, a systemic default could have been triggered even by small dispersed shocks. The results suggest that the debate on too-big-to-fail institutions should include the even more serious issue of too-central-to-fail.

Diversification and Financial Stability

|

[2011]

|

|

Tasca, Paolo;

Battiston, Stefano

|

SSRN Electronic Journal

pages: 11-001

|

more» «less

|

Abstract

The recent credit crisis of 2007/08 has raised a debate about the so-called knife-edge properties of financial markets. The paper contributes to the debate shedding light on the controversial relation between risk-diversification and financial stability. We model a financial network where assets held by borrowers to meet their obligations, include claims against other borrowers and securities exogenous to the network. The balance-sheet approach is conjugated with a stochastic setting and by a mean-field approximation the law of motion of the system's fragility is derived. We show that diversification has an ambiguous effect and beyond a certain levels elicits financial instability. Moreover, we find that risk-sharing restrictions create a socially preferable outcome. Our findings have significant implications for future policy recommendation.

Controlled Tripping of Overheated Lines Mitigates Power Outages

|

[2011]

|

|

Pfitzner, Rene;

Turitsyn, Konstantin;

Chertkov, Michael

|

|

|

more» «less

|

Abstract

We study the evolution of fast blackout cascades in the model of the Polish (transmission) power grid (2700 nodes and 3504 transmission lines). The cascade is initiated by a sufficiently severe initial contingency tripping. It propagates via sequential trippings of many more overheated lines, islanding loads and generators and eventually arriving at a fixed point with the surviving part of the system being power-flow-balanced and the rest of the system being outaged. Utilizing an improved form of the quasi-static model for cascade propagation introduced in our earlier study (Statistical Classification of Cascading Failures in Power Grids, IEEE PES GM 2011), we analyze how the severity of the cascade depends on the order of tripping overheated lines. Our main observation is that the order of tripping has a tremendous effect on the size of the resulting outage. Finding the "best" tripping, defined as causing the least damage, constitutes a difficult dynamical optimization problem, whose solution is most likely computationally infeasible. Instead, here we study performance of a number of natural heuristics, resolving the next switching decision based on the current state of the grid. Overall, we conclude that controlled intentional tripping is advantageous in the situation of a fast developing extreme emergency, as it provides significant mitigation of the resulting damage.

Statistical classification of cascading failures in power grids

|

[2011]

|

|

Pfitzner, Rene;

Turitsyn, Konstantin;

Chertkov, Michael

|

Power and Energy Society General Meeting 2011

pages: 1-8

|

more» «less

|

Abstract

We introduce a new microscopic model of the outages in transmission power grids. This model accounts for the automatic response of the grid to load fluctuations that take place on the scale of minutes, when the optimum power flow adjustments and load shedding controls are unavailable. We describe extreme events, initiated by load fluctuations, which cause cascading failures of loads, generators and lines. Our model is quasi-static in the causal, discrete time and sequential resolution of individual failures. The model, in its simplest realization based on the Directed Current description of the power flow problem, is tested on three standard IEEE systems consisting of 30, 39 and 118 buses. Our statistical analysis suggests a straightforward classification of cascading and islanding phases in terms of the ratios between average number of removed loads, generators and links. The analysis also demonstrates sensitivity to variations in line capacities. Future research challenges in modeling and control of cascading outages over real-world power networks are discussed.

Systemic risk in a unifying framework for cascading processes on networks

|

[2009]

|

|

Lorenz, Jan;

Battiston, Stefano;

Schweitzer, Frank

|

The European Physical Journal B,

pages: 441-460,

volume: 71,

number: 4

|

more» «less

|

Abstract

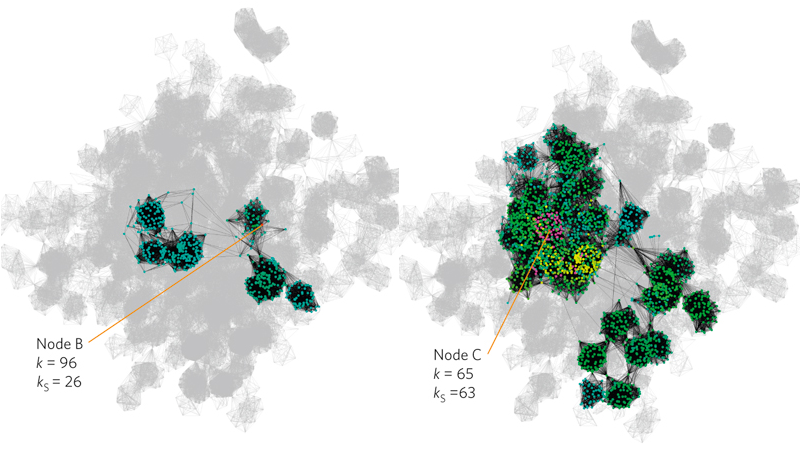

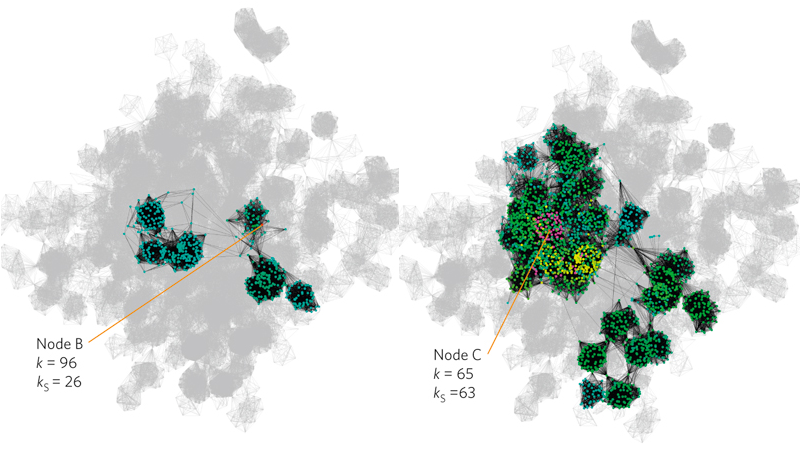

We introduce a general framework for models of cascade and contagion processes on networks, to identify their commonalities and differences. In particular, models of social and financial cascades, as well as the fiber bundle model, the voter model, and models of epidemic spreading are recovered as special cases. To unify their description, we define the net fragility of a node, which is the difference between its fragility and the threshold that determines its failure. Nodes fail if their net fragility grows above zero and their failure increases the fragility of neighbouring nodes, thus possibly triggering a cascade. In this framework, we identify three classes depending on the way the fragility of a node is increased by the failure of a neighbour. At the microscopic level, we illustrate with specific examples how the failure spreading pattern varies with the node triggering the cascade, depending on its position in the network and its degree. At the macroscopic level, systemic risk is measured as the final fraction of failed nodes, X∗,and for each of the three classes we derive a recursive equation to compute its value. The phase diagram of X∗ as a function of the initial conditions, thus allows for a prediction of the systemic risk as well as a comparison of the three different model classes. We could identify which model class leads to a first-order phase transition in systemic risk, i.e. situations where small changes in the initial conditions determine a global failure. Eventually, we generalize our framework to encompass stochastic contagion models. This indicates the potential for further generalizations.

Risk-seeking versus risk-avoiding investments in noisy periodic environments

|

[2008]

|

|

Navarro - Barrientos, Jesus Emeterio;

Walter, Frank Edward;

Schweitzer, Frank

|

International Journal of Modern Physics C,

pages: 971-994,

volume: 19,

number: 6

|

more» «less

|

Abstract

We study the performance of various agent strategies in an artificial investment scenario. Agents are equipped with a budget, x(t), and at each time step invest a particular fraction, q(t), of their budget. The return on investment (RoI), r(t), is characterized by a periodic function with different types and levels of noise. Risk-avoiding agents choose their fraction q(t) proportional to the expected positive RoI, while risk-seeking agents always choose a maximum value qmax if they predict the RoI to be positive (“everything on red”). In addition to these different strategies, agents have different capabilities to predict the future r(t), dependent on their internal complexity. Here, we compare “zero-intelligent” agents using technical analysis (such as moving least squares) with agents using reinforcement learning or genetic algorithms to predict r(t). The performance of agents is measured by their average budget growth after a certain number of time steps. We present results of extensive computer simulations, which show that, for our given artificial environment, (i) the risk-seeking strategy outperforms the risk-avoiding one, and (ii) the genetic algorithm was able to find this optimal strategy itself, and thus outperforms other prediction approaches considered.

Systemic risk in a network fragility model analyzed with probability density evolution of persistent random walks

|

[2008]

|

|

Lorenz, Jan;

Battiston, Stefano

|

Networks and Heterogeneous Media,

pages: 185,

volume: 3,

number: 2

|

more» «less

|

Abstract

We study the mean field approximation of a recent model of cascades on networks relevant to the investigation of systemic risk control in financial networks. In the model, the hypothesis of a trend reinforcement in the stochastic process describing the fragility of the nodes, induces a trade-off in the systemic risk with respect to the density of the network. Increasing the average link density, the network is first less exposed to systemic risk, while above an intermediate value the systemic risk increases. This result offers a simple explanation for the emergence of instabilities in financial systems that get increasingly interwoven. In this paper, we study the dynamics of the probability density function of the average fragility. This converges to a unique stable distribution which can be computed numerically and can be used to estimate the systemic risk as a function of the parameters of the model.

Trade Credit Networks and systemic risk

|

[2008]

|

|

Battiston, Stefano;

Delli Gatti, Domenico;

Gallegati, Mauro

|

Understanding Complex Systems,

pages: 219-239,

volume: 2008

|

more» «less

|

Abstract

In this chapter, we present a model recently introduced in [14, 16] and we discuss the features of a networked economy in which N firms are organised in M production levels. Each firm at a certain level is supplied by a subset of firms in the upper level (suppliers) and supplies a subset of the firms in the lower level (customers). The bottom level consists of retailers, i.e., firms that sell in the consumer market. The top level consists of firms that provide primary goods to the other firms. Firms are connected by means of two mech-anisms: (i) the output of supplier firms is an input for customer firms; (ii) supplier firms extend trade credit to customers (as it is typically the case in reality). However, in the model, the trade credit contract is only implicitly sketched: we neither design the optimal trade credit scheme nor look for the optimal amount of trade credit a customer firm should require. Instead, we focus on the mechanisms of propagation of bankruptcy .

|