|

Symposium "Economic Networks"

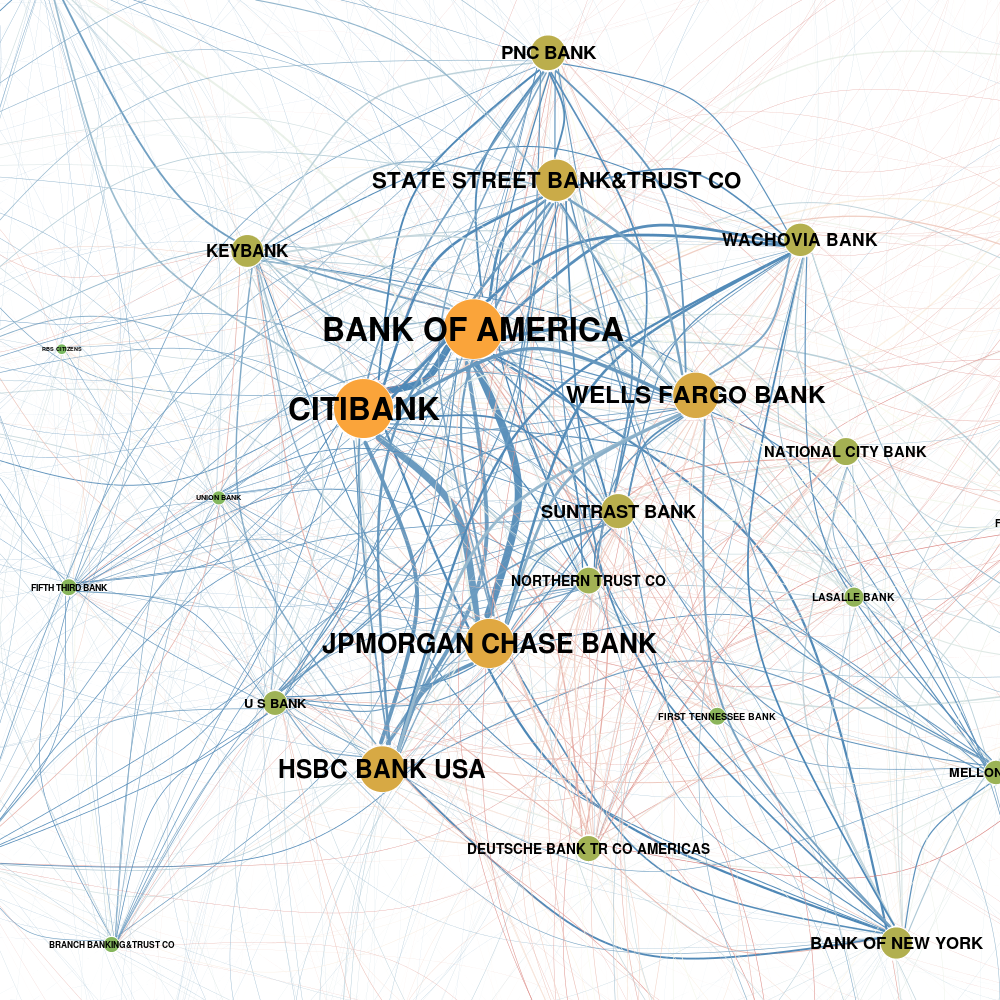

In our two perspective papers Economic Networks: The New Challenges (Science, 2009) and Economic Networks: What do we know and What do we need to know (ACS, 2009) we argue that there is a critical need for new and fundamental understanding of the structure and dynamics of economic networks. As economic systems are increasingly built on interdependencies, we need approaches to cope with the systemic complexity of the resulting networks. This requires the analysis of large-scale datasets, using new methods and new measures. But it also requires new concepts to think about economic complexity, stability and risk. Frank Schweitzer

Program

9:00 - 9:15 Opening (Prof. Frank Schweitzer)

Over the past decades, economic interest in networks has blossomed. Initial interest in networks by economists was motivated by the prevalence and functionality of inter-organizational alliances that could not be classified as markets or hierarchies. Traditionally, the emphasis laid on collaboration networks whereas only very few papers in the literature have investigated the endogenous formation of networks in models of competition and conflict. On the empirical side, signed networks are rarely investigated as negative relationships are usually omitted or underreported. We discuss different approaches to enrich the current theoretical and empirical work on the economics of networks to fully recognize the importance of competition in network formation and evolution.

R&D networks facilitate by large the production of new knowledge and the emergence of innovation. Their growing importance has inspired many works by economists aiming to explain their properties, function, and dynamics. In this talk I will summarize theoretical assumptions and discuss how they fare against real data, using a large database of publicly announced R&D alliances in several sectors over a 24-year period. This discussion shall provide perspective to the why's and how's of observed 'stylized facts', such as degree heterogeneity, small world properties, core-periphery organization etc. In addition, I will discuss the role of physical proximity in terms of geographical distance and test the widely adopted hypothesis of local buzz and global pipelines. Closing, I will present novel models that can be calibrated against real data, and that are able to reproduce empirical observables.

10:45 -11:15 Coffee Break

The global financial crisis shifted the interest from traditional measures of "risk" of individual baks to new measures of "systemic risk", defined as the risk of collapse of an entire interbank system. In principle, estimating systemic risk requires the knowledge of the whole network of exposures among banks. However, due to confidentiality issues, banks only disclose their total exposure towards the aggregate of all other banks, rather than their individual exposures towards each bank. Is it possible to statistically reconstruct the hidden structure of a network in such a way that privacy is protected, but at the same time higher-order properties are correctly predicted? In this talk, I will present a general maximum-entropy approach to the problem of network reconstruction and systemic risk estimation. I will illustrate the power of the method when applied to various economic, social, and biological systems. Then, as a counter-example, I will show how the Dutch interbank network started to depart from its reconstructed counterpart in the three years preceding the 2008 crisis. Over this period, many topological properties of the network showed a gradual transition to the crisis, suggesting their usefulness as early-warning signals of the upcoming crisis. By definition, these early warnings are undetectable if the network is reconstructed from partial bank-specific information.

|

||||||||||||||