Financial networks

After the economic downturn of 2008 the interest in research of financial networks increased. Behaviour and stability of financial institutions are highly correlated. Applying the complex networks perspective can give unique insights into financial networks.

Firms or stocks can be represented by nodes and their interaction is represented by links. Analysing network properties allows insights into the financial systems which are difficult to obtain otherwise.

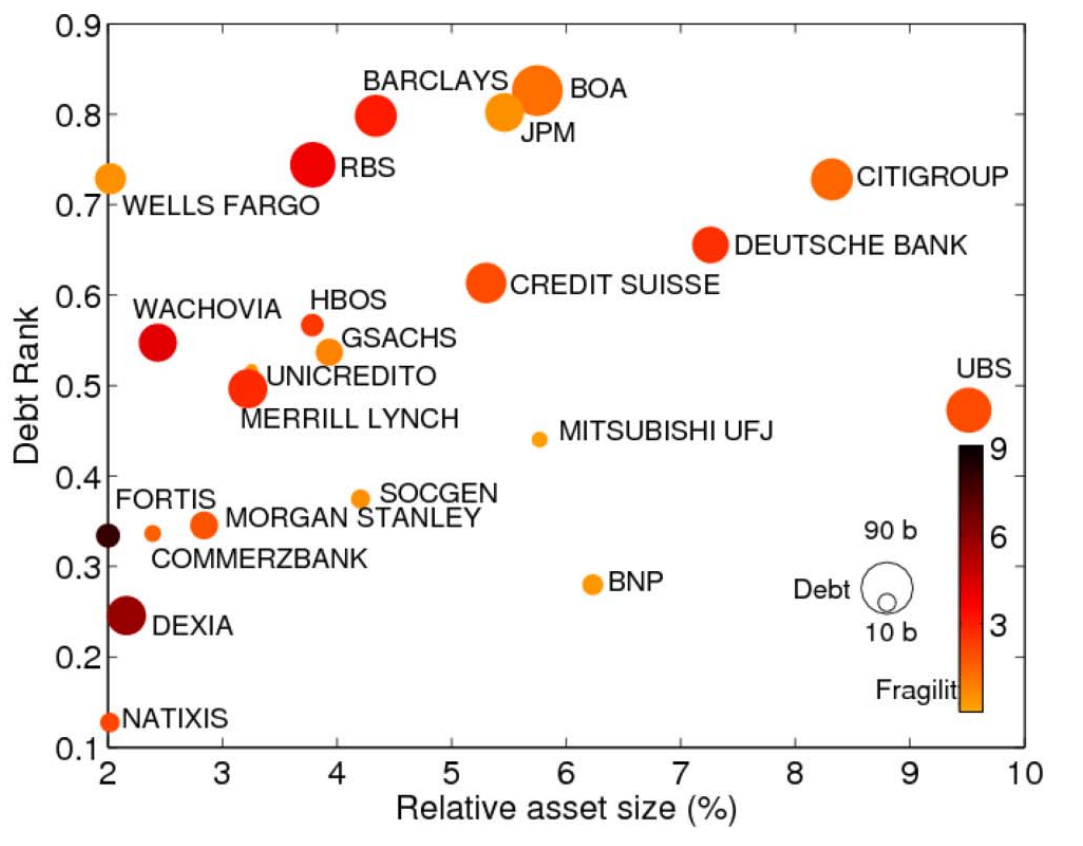

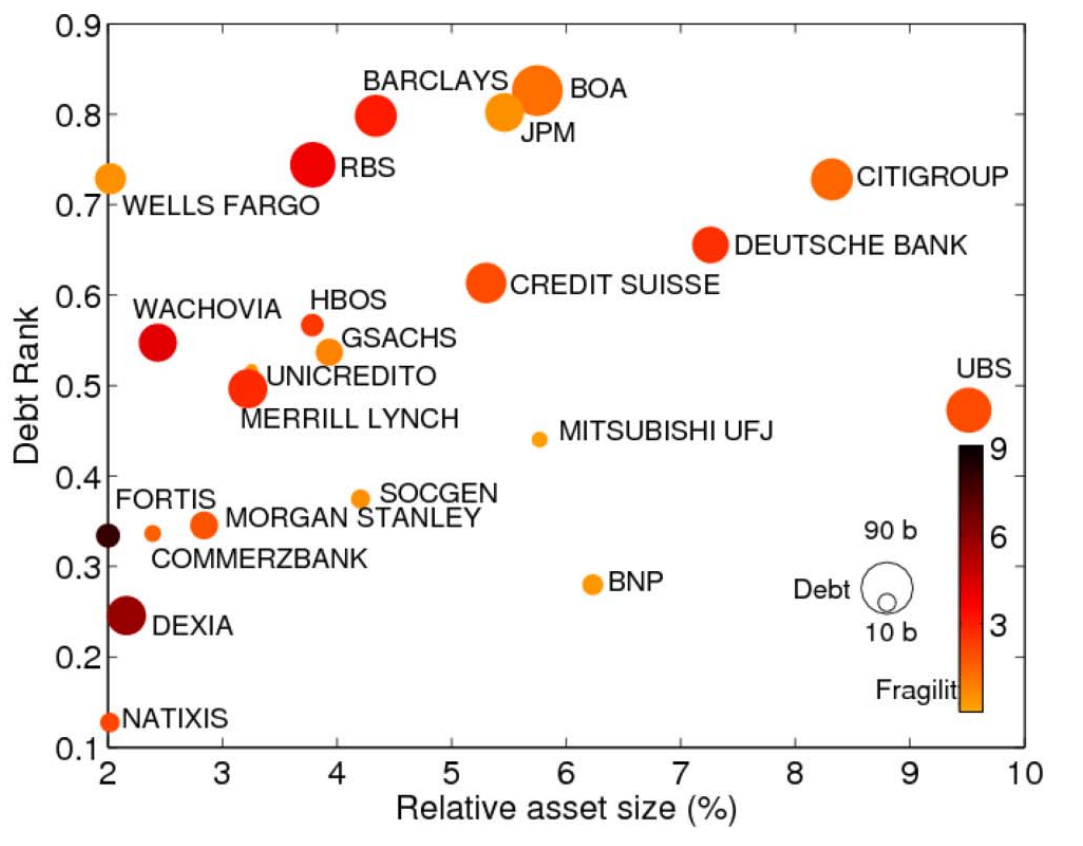

As one of the outcomes of this research, a novel and unique centrality measure has been defined which includes firms' financial and structural information. We call this novel measure the "Debt Rank''. It is able to quantify systemic impact in financial networks.

The Network of Counterparty Risk: Analysing Correlations in OTC Derivatives

|

[2015]

|

|

Nanumyan, Vahan;

Garas, Antonios;

Schweitzer, Frank

|

PLOS ONE,

pages: e0136638,

volume: 10

|

more» «less

|

Abstract

Counterparty risk denotes the risk that a party defaults in a bilateral contract. This risk not only depends on the two parties involved, but also on the risk from various other contracts each of these parties holds. In rather informal markets, such as the OTC (over-the-counter) derivative market, institutions only report their aggregated quarterly risk exposure, but no details about their counterparties. Hence, little is known about the diversification of counterparty risk. In this paper, we reconstruct the weighted and time-dependent network of counterparty risk in the OTC derivatives market of the United States between 1998 and 2012. To proxy unknown bilateral exposures, we first study the co-occurrence patterns of institutions based on their quarterly activity and ranking in the official report. The network obtained this way is further analysed by a weighted k-core decomposition, to reveal a core-periphery structure. This allows us to compare the activity-based ranking with a topology-based ranking, to identify the most important institutions and their mutual dependencies. We also analyse correlations in these activities, to show strong similarities in the behavior of the core institutions. Our analysis clearly demonstrates the clustering of counterparty risk in a small set of about a dozen US banks. This not only increases the default risk of the central institutions, but also the default risk of peripheral institutions which have contracts with the central ones. Hence, all institutions indirectly have to bear (part of) the counterparty risk of all others, which needs to be better reflected in the price of OTC derivatives.

Remarks

Find the Supporting Information at DOI:10.1371/journal.pone.0136638.s001

The power to control

|

[2013]

|

|

Galbiati, Marco;

Delpini, Danilo;

Battiston, Stefano

|

Nature Physics,

pages: 126-128,

volume: 9,

number: 3

|

more» «less

|

Abstract

Understanding something of the complexity of a financial network is one thing, influencing the behaviour of that system is another. But new tools from network science define a notion of 'controllability' that, coupled with 'centrality', could prove useful to economists and financial regulators.

Complex derivatives

|

[2013]

|

|

Battiston, Stefano;

Caldarelli, Guido;

Georg, Co - Pierre;

May, Robert;

Stiglitz, Joseph

|

Nature Physics,

pages: 123-125,

volume: 9,

number: 3

|

more» «less

|

Abstract

The intrinsic complexity of the financial derivatives market has emerged as both an incentive to engage in it, and a key source of its inherent instability. Regulators now faced with the challenge of taming this beast may find inspiration in the budding science of complex systems.

Reconstructing a credit network

|

[2013]

|

|

Caldarelli, Guido;

Chessa, Alessandro;

Pammolli, Fabio;

Gabrielli, Andrea;

Puliga, Michelangelo

|

Nature Physics,

pages: 125-126,

volume: 9,

number: 3

|

more» «less

|

Abstract

The science of complex networks can be usefully applied in finance, although there is limited data available with which to develop our understanding. All is not lost, however: ideas from statistical physics make it possible to reconstruct details of a financial network from partial sets of information.

Credit default swaps drawup networks: Too interconnected to be stable?

|

[2013]

|

|

Kaushik, Rahul;

Battiston, Stefano

|

PLOS ONE,

pages: e61815,

volume: 8,

number: 7

|

more» «less

|

Abstract

We analyse time series of CDS spreads for a set of major US and European institutions in a period overlapping the recent financial crisis. We extend the existing methodology of epsilon-drawdowns to the one of joint epsilon-drawups, in order to estimate the conditional probabilities of spike-like co-movements among pairs of spreads. After correcting for randomness and finite size effects, we find that, depending on the period of time, 50% of the pairs or more exhibit high probabilities of joint drawups and the majority of spread series are trend-reinforced, i.e. drawups tend to be followed by drawups in the same series. We then carry out a network analysis by taking the probability of joint drawups as a proxy of financial dependencies among institutions. We introduce two novel centrality-like measures that offer insights on how both the systemic impact of each node as well as its vulnerability to other nodes' shocks evolve in time.

Evolution of controllability in interbank networks

|

[2013]

|

|

Delpini, Danilo;

Battiston, Stefano;

Riccaboni, Massimo;

Gabbi, Giampaolo;

Pammolli, Fabio;

Caldarelli, Guido

|

Scientific reports,

pages: 1626,

volume: 3,

number: 1626

|

more» «less

|

Abstract

The Statistical Physics of Complex Networks has recently provided new theoretical tools for policy makers. Here we extend the notion of network controllability to detect the financial institutions, i.e. the drivers, that are most crucial to the functioning of an interbank market. The system we investigate is a paradigmatic case study for complex networks since it undergoes dramatic structural changes over time and links among nodes can be observed at several time scales. We find a scale-free decay of the fraction of drivers with increasing time resolution, implying that policies have to be adjusted to the time scales in order to be effective. Moreover, drivers are often not the most highly connected "hub" institutions, nor the largest lenders, contrary to the results of other studies. Our findings contribute quantitative indicators which can support regulators in developing more effective supervision and intervention policies.

DebtRank: Too Central to Fail? Financial Networks, the FED and Systemic Risk

|

[2012]

|

|

Battiston, Stefano;

Puliga, Michelangelo;

Kaushik, Rahul;

Tasca, Paolo;

Caldarelli, Guido

|

Scientific Reports,

pages: 541,

volume: 2

|

more» «less

|

Abstract

Systemic risk, here meant as the risk of default of a large portion of the financial system, depends on the network of financial exposures among institutions. However, there is no widely accepted methodology to determine the systemically important nodes in a network. To fill this gap, we introduce, DebtRank, a novel measure of systemic impact inspired by feedback-centrality. As an application, we analyse a new and unique dataset on the USD 1.2 trillion FED emergency loans program to global financial institutions during 2008-2010. We find that a group of 22 institutions, which received most of the funds, form a strongly connected graph where each of the nodes becomes systemically important at the peak of the crisis. Moreover, a systemic default could have been triggered even by small dispersed shocks. The results suggest that the debate on too-big-to-fail institutions should include the even more serious issue of too-central-to-fail.

Web search queries can predict stock market volumes

|

[2011]

|

|

Bordino, Ilaria;

Battiston, Stefano;

Caldarelli, Guido;

Cristelli, Matthieu;

Ukkonen, Antti;

Weber, Ingmar

|

PLOS-ONE,

pages: e40014,

volume: 7,

number: 7

|

more» «less

|

Abstract

We live in a computerized and networked society where many of our actions leave a digital trace and affect other people's actions. This has lead to the emergence of a new data-driven research field: mathematical methods of computer science, statistical physics and sociometry provide insights on a wide range of disciplines ranging from social science to human mobility. A recent important discovery is that search engine traffic (i.e., the number of requests submitted by users to search engines on the www) can be used to track and, in some cases, to anticipate the dynamics of social phenomena. Successful examples include unemployment levels, car and home sales, and epidemics spreading. Few recent works applied this approach to stock prices and market sentiment. However, it remains unclear if trends in financial markets can be anticipated by the collective wisdom of on-line users on the web. Here we show that daily trading volumes of stocks traded in NASDAQ-100 are correlated with daily volumes of queries related to the same stocks. In particular, query volumes anticipate in many cases peaks of trading by one day or more. Our analysis is carried out on a unique dataset of queries, submitted to an important web search engine, which enable us to investigate also the user behavior. We show that the query volume dynamics emerges from the collective but seemingly uncoordinated activity of many users. These findings contribute to the debate on the identification of early warnings of financial systemic risk, based on the activity of users of the www.

Patterns in high-frequency fx data : Discovery of 12 empirical scaling laws

|

[2011]

|

|

Glattfelder, James B.;

Dupuis, A.;

Olsen, R. B.

|

Quantitative Finance,

pages: 599-614,

volume: 11,

number: 4

|

more» «less

|

Abstract

We have discovered 12 independent new empirical scaling laws in foreign exchange data-series that hold for close to three orders of magnitude and across 13 currency ex-change rates. Our statistical analysis crucially depends on an event-based approach that measures the relationship between different types of events. The scaling laws give an accurate estimation of the length of the price-curve coastline, which turns out to be surprisingly long. The new laws substantially extend the catalogue of stylised facts and sharply constrain the space of possible theoretical explanations of the mar-ket mechanisms.

The Structure of Financial Networks

|

[2010]

|

|

Battiston, Stefano;

Glattfelder, James B.;

Garlaschelli, Diego;

Lillo, F;

Caldarelli, Guido

|

Network Science

pages: 131-163

|

more» «less

|

Abstract

We present here an overview of the use of networks in Finance and Economics. We show how this approach enables us to address important questions as, for example, the structure of control chains in financial systems, the systemic risk associated with them and the evolution of trade between nations. All these results are new in the field and allow for a better understanding and modelling of different economic systems.

Are Output Growth-Rate Distributions Fat-Tailed? Some Evidence from OECD Countries

|

[2008]

|

|

Fagiolo, Giorgio;

Roventini, Andrea;

Napoletano, Mauro

|

Journal of Applied Econometrics,

pages: 639-669,

volume: 23

|

more» «less

|

Abstract

This work explores some distributional properties of aggregate output growth-rate time series. We show that, in the majority of OECD countries, output growth-rate distributions are well-approximated by symmetric exponential-power densities with tails much fatter than those of a Gaussian. Fat tails robustly emerge in output growth rates independently of: (i) the way we measure aggregate output; (ii) the family of densities employed in the estimation; (iii) the length of time lags used to compute growth rates. We also show that fat tails still characterize output growth-rate distributions even after one washes away outliers, autocorrelation and heteroscedasticity.

Investments in random environments

|

[2008]

|

|

Navarro - Barrientos, Jesus Emeterio;

Cantero, Ruben;

Rodrigues, Joao F.;

Schweitzer, Frank

|

Physica A,

pages: 2035-2046,

volume: 387,

number: 8-9

|

more» «less

|

Abstract

We present analytical investigations of a multiplicative stochastic process that models a simple investor dynamics in a random environment. The dynamics of the investor's budget, $x(t)$, depends on the stochasticity of the return on investment, $r(t)$, for which different model assumptions are discussed. The fat-tail distribution of the budget is investigated and compared with theoretical predictions. Weare mainly interested in the most probable value $x_mp$ of the budget that reaches a constant value over time. Based on an analytical investigation of the dynamics, we are able to predict $x_mp^stat$. We find a scaling law that relates the most probable value to the characteristic parameters describing the stochastic process. Our analytical results are confirmed by stochastic computer simulations that show a very good agreement with the predictions.

Trade Credit Networks and systemic risk

|

[2008]

|

|

Battiston, Stefano;

Delli Gatti, Domenico;

Gallegati, Mauro

|

Understanding Complex Systems,

pages: 219-239,

volume: 2008

|

more» «less

|

Abstract

In this chapter, we present a model recently introduced in [14, 16] and we discuss the features of a networked economy in which N firms are organised in M production levels. Each firm at a certain level is supplied by a subset of firms in the upper level (suppliers) and supplies a subset of the firms in the lower level (customers). The bottom level consists of retailers, i.e., firms that sell in the consumer market. The top level consists of firms that provide primary goods to the other firms. Firms are connected by means of two mech-anisms: (i) the output of supplier firms is an input for customer firms; (ii) supplier firms extend trade credit to customers (as it is typically the case in reality). However, in the model, the trade credit contract is only implicitly sketched: we neither design the optimal trade credit scheme nor look for the optimal amount of trade credit a customer firm should require. Instead, we focus on the mechanisms of propagation of bankruptcy .

The Network of Inter-regional Direct Investment Stocks across Europe

|

[2007]

|

|

Battiston, Stefano;

Rodrigues, Joao F.;

Zeytinoglu, Hamza

|

ACS - Advances in Complex Systems,

pages: 29-51,

volume: 10,

number: 1

|

more» «less

|

Abstract

We propose a methodological framework to study the dynamics of inter-regional investment flow in Europe from a Complex Networks perspective, an approach with recent proven success in many fields including economics. In this work we study the network of investment stocks in Europe at two different levels: first, we compute the inward-outward investment stocks at the level of firms, based on ownership shares and number of employees; then we estimate the inward-outward investment stock at the level of regions in Europe, by aggregating the ownership network of firms, based on their headquarter location. Despite the intuitive value of this approach for EU policy making in economic development, to our knowledge there are no similar works in the literature yet. In this paper we focus on statistical distributions and scaling laws of activity, investment stock and connectivity degree both at the level of firms and at the level of regions. In particular we find that investment stock of firms is power law distributed with an exponent very close to the one found for firm activity. On the other hand investment stock and activity of regions turn out to be log-normal distributed. At both levels we find scaling laws relating investment to activity and connectivity. In particular, we find that investment stock scales with connectivity in a similar way as has been previously found for stock market data, calling for further investigations on a possible general scaling law holding true in economical networks.

|