OTC Derivatives and Systemic Risk in Financial Networks

This project is related to our research lines: Systemic Risk and Financial networks

Duration 36 months (August 2010 - July 2013)

Funding source Swiss National Science Foundation (Grant CR12I1-127000 / 1)

OTC derivatives are financial instruments that are traded outside of regulated markets (OTC = over the counter). Formally, derivatives are specified as contracts between two parties. Thus, in the absence of a clearing house, counterparty risk, i.e. the risk that a counterparty fails, is the main source of risk. The main goal of this project is to contribute to the understanding of the relation between the presence and structure of OTC networks and systemic risk.

The lack of theoretical frameworks to deal with distress in financial networks in the presence of OTC derivatives has motivated our project. While models exist to describe the distress of institutions in isolation, new problems arise when balance sheets of institutions become interdependent, this way forming a network of risk between institutions. During the whole project, we have developed several models to deal with default probabilities of financial institutions in a network context where links represent credit relations and OTC derivatives. Our models show two major effects: On the one hand, even if at individual level OTC contracts can be used to mitigate risk, at a system level they increase the interdependence between institutions and the uncertainty about the probability of systemic events. On the other hand, in the presence of a network of credit and a network of OTC contracts, a tail emerges in the distribution of losses, even when the underlying distribution of shocks on the assets held by the institutions is Gaussian. This means in practice that OTC tend to amplify the uncertainty of systemic events.

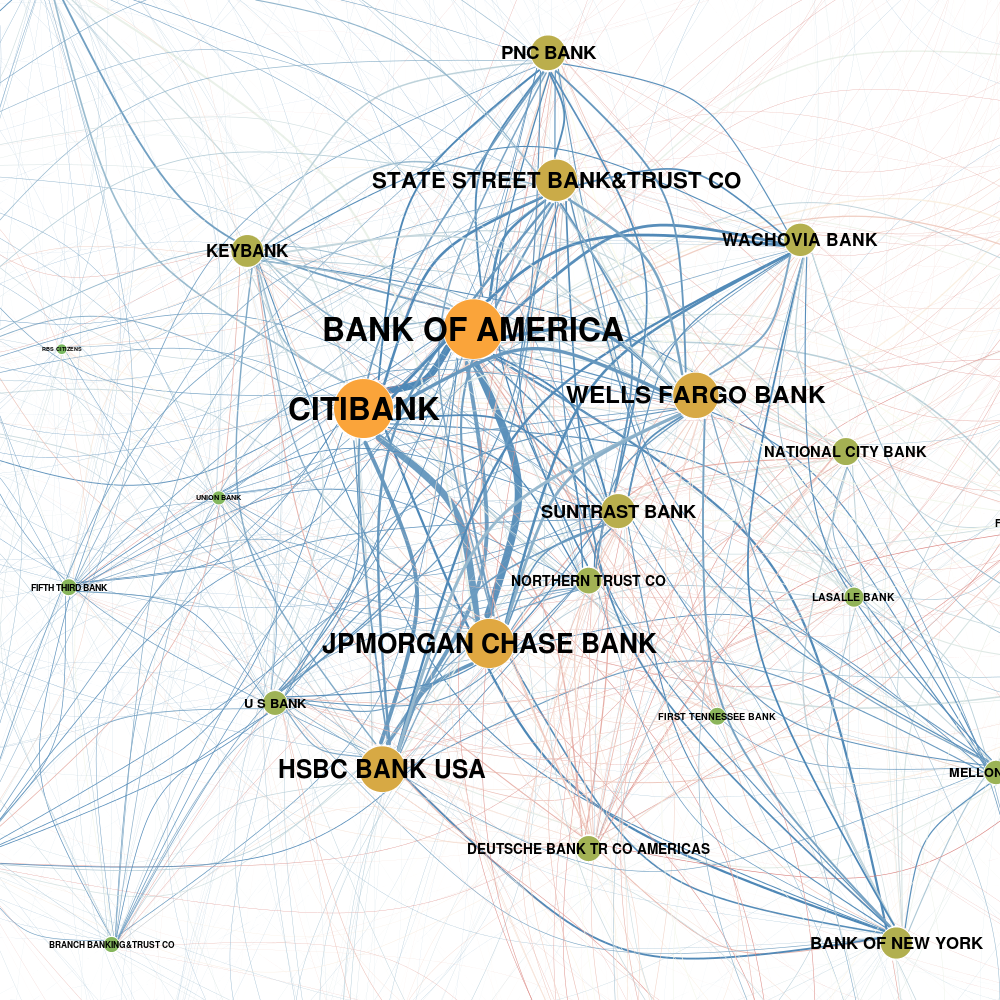

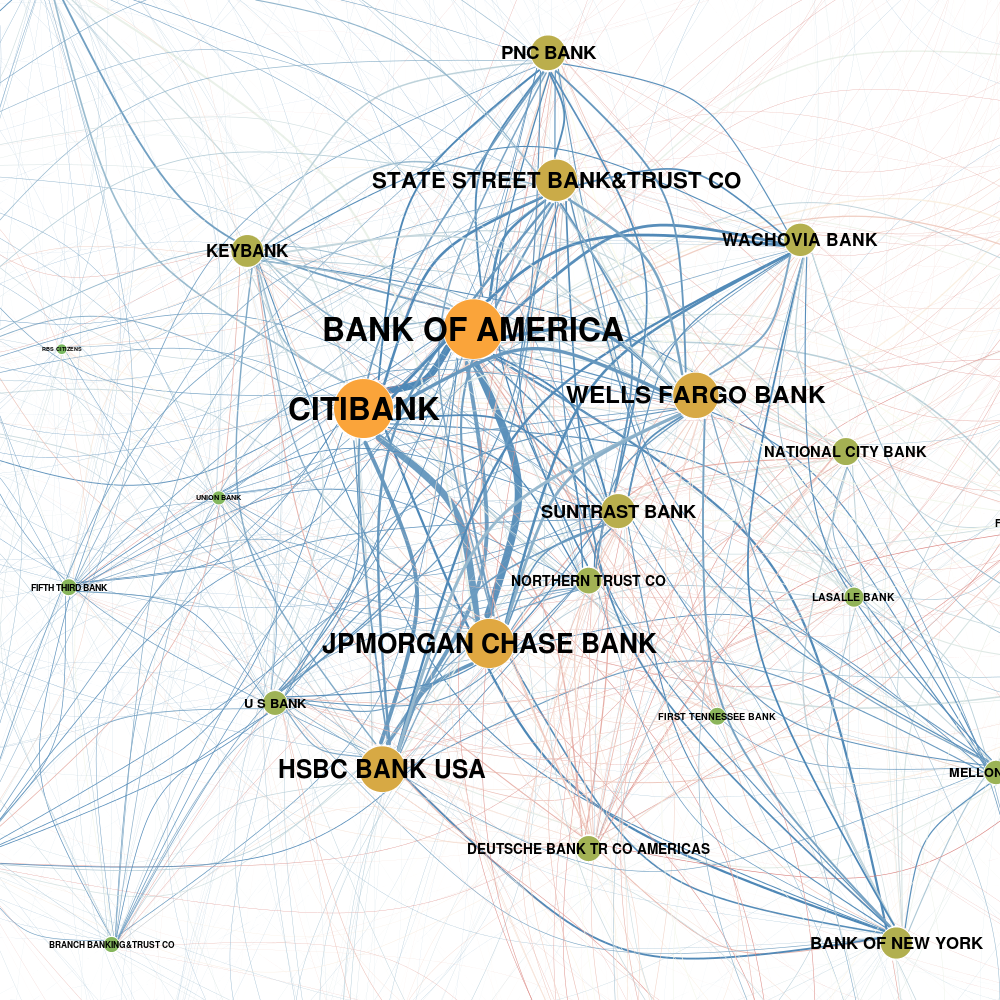

On the empirical side, it is a challenge that OTC data are extremely difficult to access and, even then, hard to handle. We have coped with this difficulty by resorting to the technique of inferring proxies of network structures from time series of Credit Default Swaps, a popular type of OTC contract. But we have been able to access data about the network of OTC contracts in Germany and in the USA. To our knowledge, we have contributed some of the first empirical analyses of a real derivative network among a large number of banks, which allows to draw some insights on the structure of real OTC networks.

The Network of Counterparty Risk: Analysing Correlations in OTC Derivatives

|

[2015]

|

|

Nanumyan, Vahan;

Garas, Antonios;

Schweitzer, Frank

|

PLOS ONE,

pages: e0136638,

volume: 10

|

more» «less

|

Abstract

Counterparty risk denotes the risk that a party defaults in a bilateral contract. This risk not only depends on the two parties involved, but also on the risk from various other contracts each of these parties holds. In rather informal markets, such as the OTC (over-the-counter) derivative market, institutions only report their aggregated quarterly risk exposure, but no details about their counterparties. Hence, little is known about the diversification of counterparty risk. In this paper, we reconstruct the weighted and time-dependent network of counterparty risk in the OTC derivatives market of the United States between 1998 and 2012. To proxy unknown bilateral exposures, we first study the co-occurrence patterns of institutions based on their quarterly activity and ranking in the official report. The network obtained this way is further analysed by a weighted k-core decomposition, to reveal a core-periphery structure. This allows us to compare the activity-based ranking with a topology-based ranking, to identify the most important institutions and their mutual dependencies. We also analyse correlations in these activities, to show strong similarities in the behavior of the core institutions. Our analysis clearly demonstrates the clustering of counterparty risk in a small set of about a dozen US banks. This not only increases the default risk of the central institutions, but also the default risk of peripheral institutions which have contracts with the central ones. Hence, all institutions indirectly have to bear (part of) the counterparty risk of all others, which needs to be better reflected in the price of OTC derivatives.

Remarks

Find the Supporting Information at DOI:10.1371/journal.pone.0136638.s001

Quantifying the Impact of Leveraging and Diversification on Systemic Risk

|

[2014]

|

|

Tasca, Paolo;

Mavrodiev, Pavlin;

Schweitzer, Frank

|

Journal of Financial Stability,

pages: 43-52,

volume: 15,

number: 0

|

more» «less

|

Abstract

The excessive increase of leverage, i.e. the abuse of debt financing, is considered one of the primary factors in the default of financial institutions since it amplifies potential investment losses. On the other side, portfolio diversification acts to mitigate these losses. Systemic risk results from correlations between individual default probabilities that cannot be considered independent. Based on the structural framework by Merton (1974), we propose a model in which these correlations arise from overlaps in banks’ portfolios. Our main result is the finding of a critical level of diversification that separates two regimes: (i) a safe regime in which a properly chosen diversification strategy offsets the higher systemic risk engendered by increased leverage and (ii) a risky regime in which an inadequate diversification strategy and/or adverse market conditions, such as market size, market volatility and time horizon, cannot compensate the same increase in leverage. Our results are of relevance for financial regulators especially because the critical level of diversification may not coincide with the one that is individually optimal.

Complex derivatives

|

[2013]

|

|

Battiston, Stefano;

Caldarelli, Guido;

Georg, Co - Pierre;

May, Robert;

Stiglitz, Joseph

|

Nature Physics,

pages: 123-125,

volume: 9,

number: 3

|

more» «less

|

Abstract

The intrinsic complexity of the financial derivatives market has emerged as both an incentive to engage in it, and a key source of its inherent instability. Regulators now faced with the challenge of taming this beast may find inspiration in the budding science of complex systems.

The power to control

|

[2013]

|

|

Galbiati, Marco;

Delpini, Danilo;

Battiston, Stefano

|

Nature Physics,

pages: 126-128,

volume: 9,

number: 3

|

more» «less

|

Abstract

Understanding something of the complexity of a financial network is one thing, influencing the behaviour of that system is another. But new tools from network science define a notion of 'controllability' that, coupled with 'centrality', could prove useful to economists and financial regulators.

Market Procyclicality and Systemic Risk

|

[2012]

|

|

Tasca, Paolo;

Battiston, Stefano

|

SSRN Electronic Journal

|

more» «less

|

Abstract

We model the systemic risk associated with the so-called balance-sheet amplification mechanism in a system of banks with interlocked balance sheets and with positions in real-economy-related assets. Our modeling framework integrates a stochastic price dynamics with an active balance-sheet management aimed to maintain the Value-at-Risk at a target level. We find that a strong compliance with capital requirements, usually alleged to be procyclical, does not increase systemic risk unless the asset market is illiquid. Conversely, when the asset market is illiquid, even a weak compliance with capital requirements increases significantly systemic risk. Our findings have implications in terms of possible macro-prudential policies to mitigate systemic risk.

DebtRank: Too Central to Fail? Financial Networks, the FED and Systemic Risk

|

[2012]

|

|

Battiston, Stefano;

Puliga, Michelangelo;

Kaushik, Rahul;

Tasca, Paolo;

Caldarelli, Guido

|

Scientific Reports,

pages: 541,

volume: 2

|

more» «less

|

Abstract

Systemic risk, here meant as the risk of default of a large portion of the financial system, depends on the network of financial exposures among institutions. However, there is no widely accepted methodology to determine the systemically important nodes in a network. To fill this gap, we introduce, DebtRank, a novel measure of systemic impact inspired by feedback-centrality. As an application, we analyse a new and unique dataset on the USD 1.2 trillion FED emergency loans program to global financial institutions during 2008-2010. We find that a group of 22 institutions, which received most of the funds, form a strongly connected graph where each of the nodes becomes systemically important at the peak of the crisis. Moreover, a systemic default could have been triggered even by small dispersed shocks. The results suggest that the debate on too-big-to-fail institutions should include the even more serious issue of too-central-to-fail.

Diversification and Financial Stability

|

[2011]

|

|

Tasca, Paolo;

Battiston, Stefano

|

SSRN Electronic Journal

pages: 11-001

|

more» «less

|

Abstract

The recent credit crisis of 2007/08 has raised a debate about the so-called knife-edge properties of financial markets. The paper contributes to the debate shedding light on the controversial relation between risk-diversification and financial stability. We model a financial network where assets held by borrowers to meet their obligations, include claims against other borrowers and securities exogenous to the network. The balance-sheet approach is conjugated with a stochastic setting and by a mean-field approximation the law of motion of the system's fragility is derived. We show that diversification has an ambiguous effect and beyond a certain levels elicits financial instability. Moreover, we find that risk-sharing restrictions create a socially preferable outcome. Our findings have significant implications for future policy recommendation.

|